Sixty-five Sydney and Melbourne markets struggle to attract buyers

CoreLogic research showed 65 Sydney and Melbourne unit markets remain below their 2010s peak values, with improved affordability and vendor losses still failing to attract buyers.

“The fall in business turnover was driven by a 3.5% fall in mining,” said Eliza Owen (pictured above), head of residential research Australia at CoreLogic.

Why are buyers hesitant?

The main issue driving buyer reluctance is the “wrong kind of supply.”

Much of the available stock in these markets consists of investment-grade units constructed during a boom in the 2010s. These properties, heavily aimed at investors, were built in high density and are often seen as unsuitable for today’s first-home buyers.

Sydney leads the underperforming markets

While Melbourne’s unit market has experienced weaker growth overall, Sydney accounts for 51 of the 65 underperforming unit markets identified by CoreLogic.

Areas like Epping have seen median unit values drop significantly. In fact, Epping’s unit market is down 18.4% from its 2017 peak, with a median unit price just under $800,000.

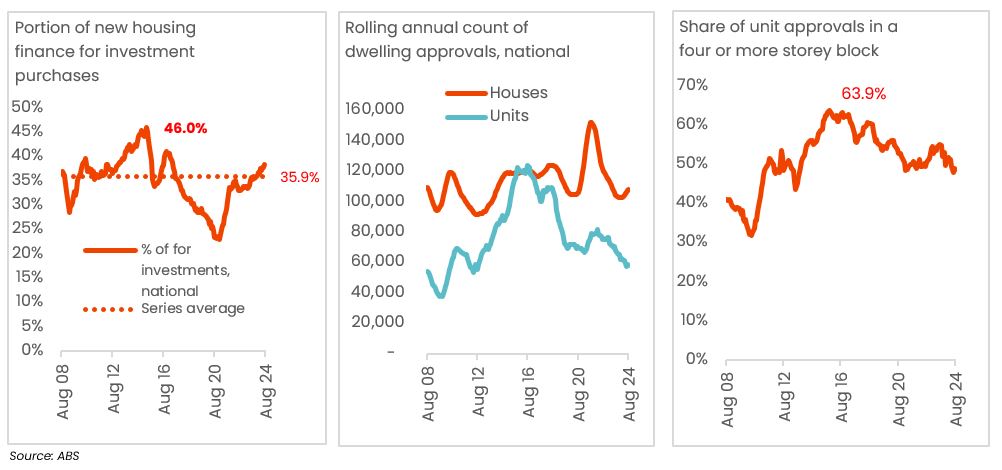

A record share of housing finance was allocated to investors, leading to a glut of units, especially in central and middle-ring suburbs of Sydney and Melbourne.

At its peak in 2015, investor loans made up 46% of new housing finance. However, with an interest-only lending cap introduced in 2017, investor demand quickly dropped, leaving these markets with a surplus of units that haven’t appealed to today’s buyers, CoreLogic reported.

Some markets show signs of recovery

Despite the overall trend, some unit markets have experienced a recent resurgence in value.

In Tallawong, for example, unit prices have risen by 11.9% in the past year, likely driven by the opening of the Northwest Metro line. Similarly, areas such as Punchbowl, Lakemba, and Parkville have shown solid growth while maintaining median unit values below $600,000.

These trends suggest that buyers may return to certain medium- and high-density markets – if the price is attractive enough.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!