Home prices up 39.9% nationally since COVID’s start, says PropTrack

New PropTrack report has highlighted the astounding growth in home prices since the pandemic began, with a national surge of 39.9%.

“From fears of sharp falls through the pandemic, to predictions of steep declines when interest rates began to quickly climb, home prices have defied the expectations of many,” said Eleanor Creagh (pictured above), senior economist at PropTrack.

This unexpected resilience throughout this four-year period has been influenced by factors such as supply, population growth, rental market conditions, and interest rates.

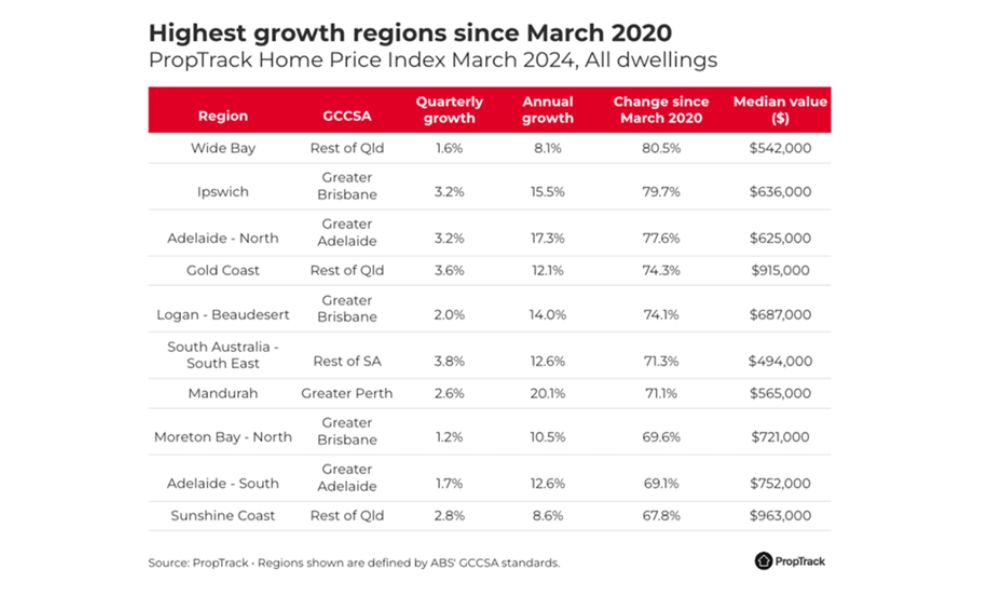

Regional markets outshine capitals

The past year saw capital city markets outperform regional areas, yet since the pandemic’s start, regional home prices have significantly outperformed their capital city counterparts, except in WA and NT. Regional Queensland leads the growth with a 66.5% increase, demonstrating the continued appeal of these areas.

Shifts in housing preferences

The pandemic caused a shift towards smaller household sizes, space, and lifestyle over proximity to the CBD.

“Closed international borders and more time at home caused housing preferences to shift,” Creagh said, noting the surge in coastal and regional property prices.

Challenges for first-time buyers

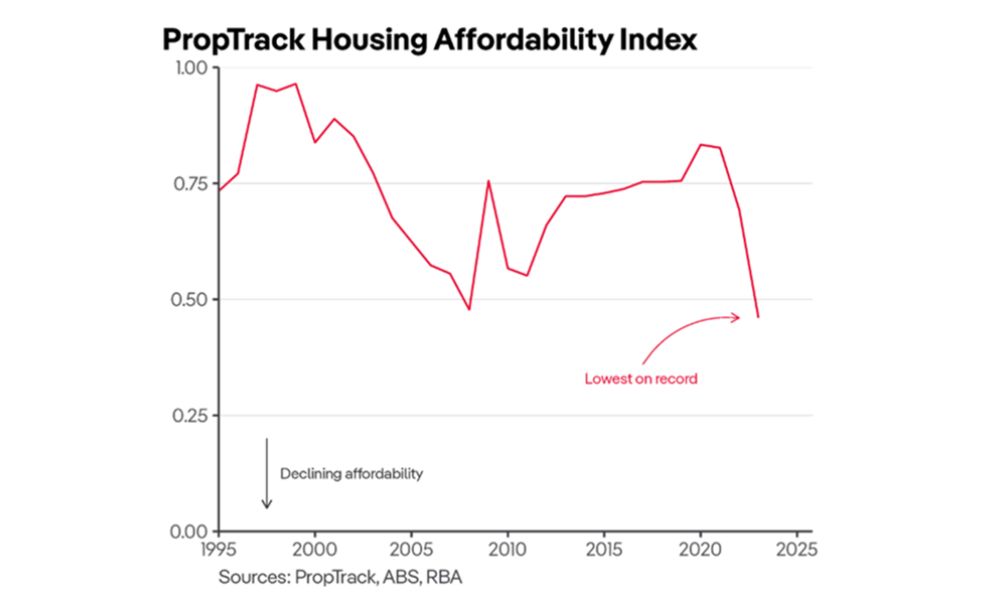

Despite the market’s upturn, challenges loom for first-time buyers, particularly those with lower incomes. The significant price surge over the past four years has exacerbated housing affordability, hitting its worst level in three decades. However, existing homeowners have seen equity gains, cushioning them from the high-interest rate environment.

Housing supply struggles to keep up

With the population growing at the fastest pace in 72 years and net migration surging, the spotlight is on the housing shortage. The building industry faces higher financing costs, material costs, labour shortages, and an uptick in insolvencies, slowing the delivery of new housing.

“It’s clear we’re not building enough homes,” Creagh said.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.

Keep up with the latest news and events

Join our mailing list, it’s free!