Buying a property (home/plot/land) is one of the most important decisions that you will ever make. Buying a property involves a lot of money and it is a serious money decision.

When buying a property, due diligence is critical, and several important documents must be carefully verified. Among all of them, the sale deed deserves special attention, as it is the single most important document that legally establishes ownership of the property.

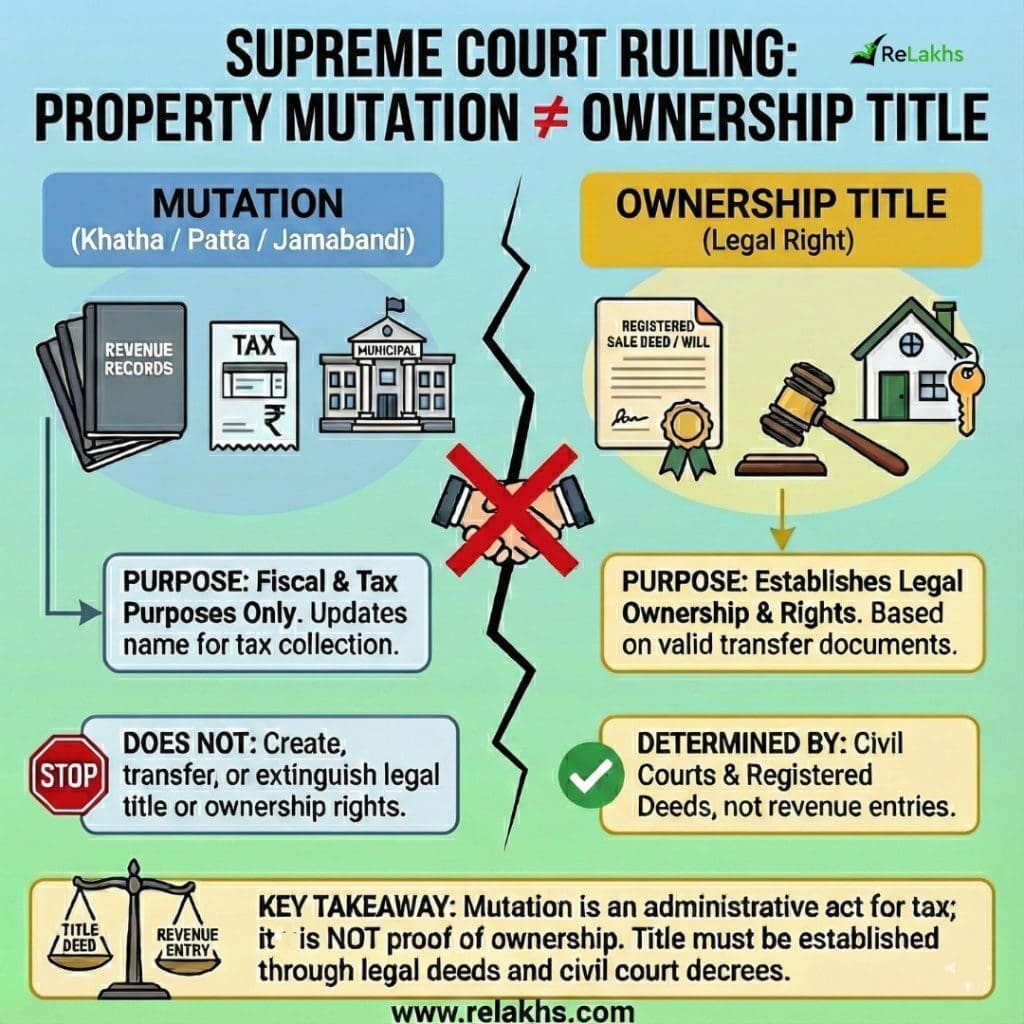

There’s another important document in a property transaction which may not establish ownership, but is equally important—mutation (also known as Khata or Jamabandi). Property mutation has been in the spotlight recently, with important legal updates and rule changes grabbing attention.

Let me explain this in detail.

In 2019, the Bihar government amended its Registration Rules to include clauses that required sellers to produce proof of property mutation (like Jamabandi or Khatha) before a sub-registrar could register sale deeds or gift deeds. This effectively meant that mutation had to be completed first before registration could proceed. (My take: Ideally, this is how it should be!)

However, in November 2025, the Supreme Court of India struck down those specific provisions that made mutation proof a mandatory precondition for registering sale and gift deeds.

“In one of its other recent rulings (2025), the Supreme Court reiterated that if serious disputes arise concerning the validity, authenticity, or execution of a Will/Deed, such matters must be referred to a competent civil court for resolution. The role of the revenue authority is limited to administrative recording and does not extend to adjudicating complex questions of title or the validity of testamentary documents. Revenue authorities cannot decide ownership disputes.”

So, it becomes essential to clearly understand a few key questions: What exactly is property mutation? How is mutation different from a sale deed? And why is property mutation so important (even though it does not legally confer ownership)?

What is Mutation of Property?

Mutation is the change of title ownership from one person to another when the property is sold or transferred. By mutating a property, the new owner gets the title of the property recorded on his/her name in the land revenue department and the government is able to charge property tax from the rightful owner.

One needs to get mutation done and get the new owner details updated in the revenue records maintained by civic bodies like Municipalities, Panchayats or Municipal Corporations.

Sale deed = legal ownership (title)

Mutation = revenue record update

Property Sale Deed Vs Property Mutation

Registration of the property is a full and final agreement signed between two parties ie., buyer and seller. Once a property is registered, it means that the property buyer in whose favor the property is registered will become the lawful owner of the property and is fully responsible for it in all respects. The new owner is liable to pay property taxes, development charges etc which are levied by the local civic body.

Once the property is registered in Sub-registrar office, the buyer of the property has to get the title of the property updated in his/her name in the local revenue office (municipality or panchayat office). This is known as mutation. Once the property is updated in the revenue records, henceforth the new owner has to pay the applicable taxes to the civic body (like property tax, development charges etc.,).

So, registration of property and mutation of property are two different things. Mutation of property happens after the registration of property.

When you register a property through a sale deed, it happens at the sub-registrar’s office. Mutation, on the other hand, is done at the local civic body or revenue office. In most states in India, registering a property doesn’t automatically update the land records in the revenue office.

| Property Registration (Sale Deed) | Property Mutation (Khata/Patta/Jamabandi) |

|---|---|

| It is also known as ‘Conveyance Deed’ | It also known as Katha or Patta, |

| On execution, Property gets transferred from one person to another. | The name of tax payer gets entered in Revenue tax records. |

| Registration can be done without a ‘mutation record’. | Based on ‘Sale Deed’ or ‘Gift Deed’, the buyer can get mutation done. |

| A Sale Deed without Mutation is still a legally valid document | Without a Sale Deed, Mutation is invalid and illegal |

| A must-have document for any type of Property. | In case of Agricultural lands, mutation is must. |

| Deed Ownership title can be cross-checked through Encumbrance Certificate | Mutation record can be cross-checked through a Mutation or Khatha Extract |

Why Property Mutation is important?

- Shows the type of land — whether agricultural or non-agricultural.

- Provides location details of the property, such as village, ward, or municipal boundaries.

- Includes survey or plot information, like survey number, plot number, and land boundaries.

- Records property tax or revenue details, including assessment and who is liable to pay.

- Indicates whether the land is vacant or occupied.

- Confirms who currently has possession of the property.

- Serves as an important document when applying for loans from banks or financial institutions.

- Required to avail government subsidies or schemes related to the property.

Let me give you an idea of how significant mutation-related grievances are in my home state, Andhra Pradesh.

The Andhra Pradesh government operates a portal on Public Grievance Redressal System covering all departments. It provides a clear view of the various grievances submitted by the public across different departments.

According to an official Public Grievance Redressal System report from mid-2025:

- The total number of grievances registered across all state govt departments on the PGRS portal were over 10,41,000 as of July 2025.

- Land Revenue-Related Grievances

- Within that overall figure, revenue department issues (such as complaints on mutations, correction of entries in records, survey/land record disputes, etc.) were among the top grievance categories.

- The total number of revenue grievances reported in that dataset included:

- Property Mutations: ~105,345 (that’s 10% of total grievances)

- Survey settlements / land records – extent variations: ~98,860

- Correction of entries in revenue records: ~92,943

Considering the volume of public grievances, the situation is likely similar in other Indian states. Therefore, it is the responsibility of the property buyer to verify mutations before finalizing a property deal, helping to avoid future legal disputes.

Procedure for Property Mutation

Remember, you need to get the transfer of title of property (mutation) done in the below circumstances;

- After buying/purchasing a property.

- After inheriting a property through a Will or without a Will.

- After acquiring a property through a Gift Deed or other forrms of registered deeds.

The buyer or new owner must submit an application to the local civic body (such as the Tehsildar) or the concerned revenue office. The application typically requires details like the applicant’s personal information, property address, date of registration, mode of transfer (registered sale deed, gift deed, Will, etc.), and key property particulars.

The applicable fee must be paid as prescribed, usually through a demand draft. For instance, in Bengaluru, the Khata transfer fee is 2% of the stamp duty paid at the time of property registration. Fee structures, however, differ from state to state.

So, completing mutation ensures you are legally recorded as the owner in the revenue system. Checking revenue grievances helps you identify potential problems before buying, transferring, or mortgaging a property.

A registered sale deed gives you legal ownership.

But incomplete mutation can still drag you into years of legal disputes.

I believe some Indian states and Andhra Pradesh local bodies (e.g., Vijayawada Corporation) integrate Registration & Revenue depts, auto-updating land records (mutation) post-registration. Great step forward!

Related articles :

(Post first published on : 31-Dec-2025)