EPFO’s proposed PF withdrawal rules (2025-2026) massively simplifies the rules but also makes it easier to eat into long‑term retirement savings if used casually.

For years, employees had to deal with 13 different PF withdrawal rules, varying service conditions and many claim rejections, despite this being their own money. The newly proposed EPF rules merge everything into three clear categories and allow members to withdraw up to 75% of their total balance, including the employer’s share, with very little paperwork, while keeping at least 25% locked in as retirement protection.

In this article, let’s decode what exactly has changed in the new PF withdrawal framework, how it will impact your short‑term cash flows as well as long‑term retirement corpus, and how to use this newfound flexibility without falling into the trap of treating EPF like just another savings account.

Why EPFO Changed The Rules

- EPFO manages a corpus of around ₹28 lakh crore and over 30 crore members, and found that 50% of members retired with less than ₹20,000 in their PF balance due to repeated small withdrawals.

- To reduce confusion from 13+ separate advance provisions (Para 68B, 68K, etc.), the Central Board of Trustees (CBT) in its 238th meeting decided to merge them into one unified framework with three easy‑to‑understand categories.

New EPF Withdrawal Rules 2025-26

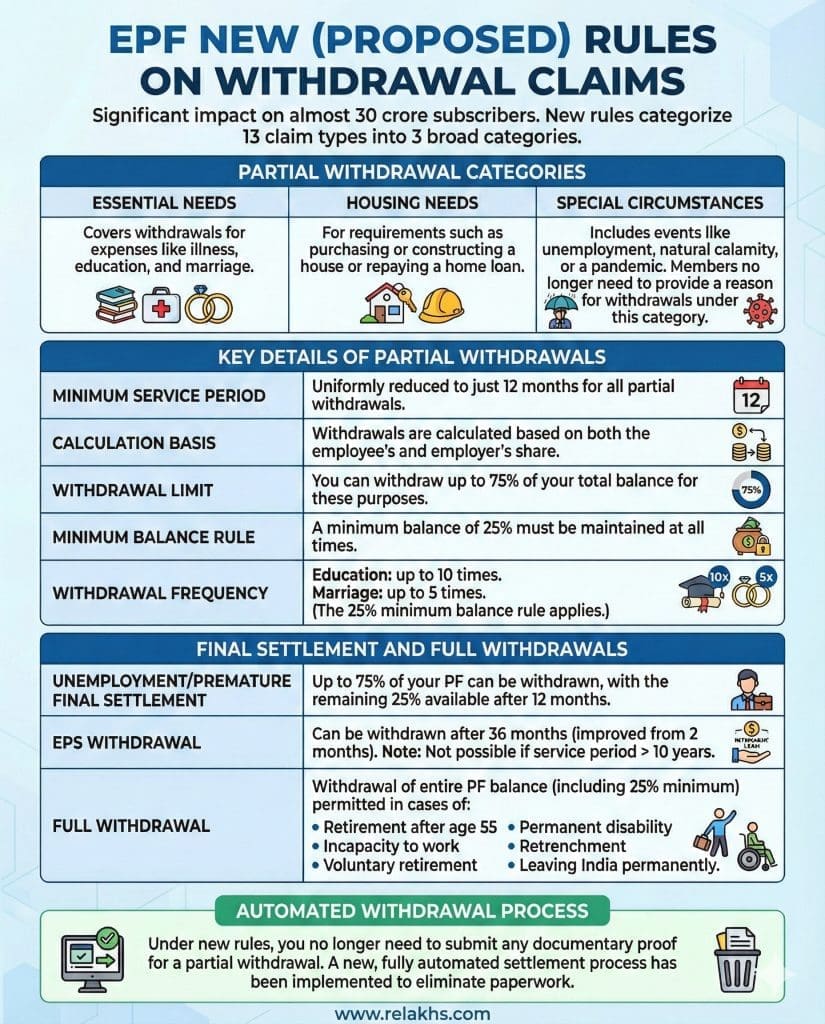

The EPFO has categorized the existing 13 different types of partial withdrawal claims into three broad categories:

- Essential Needs: Covers withdrawals for expenses like illness, education, and marriage.

- Housing Needs: For requirements such as purchasing or constructing a house or repaying a home loan.

- Special Circumstances: This includes events like unemployment, natural calamity, or a pandemic. Members no longer need to provide a reason for withdrawals under this category.

Key Rules For Partial Withdrawals

- Members can withdraw up to 75% of the total PF balance (employee + employer share + interest) for the above mentioned purposes, subject to keeping 25% as a minimum balance and to the frequency caps explained below.

- Frequency caps (min balance 25% need to be maintained):

- For education, partial withdrawals are allowed up to 10 times during membership

- For marriage, partial withdrawals are allowed up to 5 times during membership

- For illness, partial withdrawals are allowed up to 3 times every financial year

- For Housing needs, partial withdrawals are allowed up to 5 times during the membership

- For Special circumstance, advance withdrawals are allowed up to 2 times every financial year.

- Earlier, minimum service requirements varied between 5 and 7 years depending on the purpose; now all partial withdrawals need just 12 months of total service

Final Settlement, Unemployment & EPS Withdrawal

Unemployment and premature final settlement

- In case of job loss or unemployment, members can now withdraw 75% of the PF balance (including employer share) immediately, with the remaining 25% allowed after 12 months of continuous unemployment if they choose not to remain members.

EPS (pension) withdrawal rules

- The Employees’ Pension Scheme (EPS) continues to require a minimum 10 years of pensionable service to qualify for lifelong pension at 58; if you withdraw EPS earlier, you forfeit future pension rights.

- To discourage early exit, the withdrawal benefit under EPS will now be available after 36 months instead of the earlier 2‑month window, giving members more time to resume contributions and preserve pension eligibility; note that EPS withdrawal is not possible once service exceeds 10 years.

(Related article : What happens to EPS on Transfer of EPF account (or) when you switch Jobs?)

Full withdrawal of PF balance

- A member can still withdraw 100% of the PF balance (including the nominal 25% minimum) in specific situations: retirement after age 55, permanent and total disability, medically certified incapacity, retrenchment, voluntary retirement under an approved scheme, or leaving India permanently.

- The Ministry has clarified that the pension entitlement at 58 remains unaffected by these changes as long as the member has not withdrawn EPS and has the required years of service.

Fully Automated, No‑Document Claims – Boon Or Trap?

EPFO’s new auto‑settlement system

- EPFO has rolled out a fully digital, “zero‑documentation” process for most partial withdrawals, meaning members no longer need to upload proof for illness, education, housing or other approved purposes.

- As part of this push, the organisation processed 2.16 crore claims in auto‑mode in FY 2024‑25 (up to 6 March 2025), compared with 89.52 lakh auto‑mode claims in FY 2023‑24, and such claims are now settled within about three days.

Why easy access can be risky

- Behaviourally, the easier money feels, the more casually it tends to be spent; turning EPF into a quasi‑savings‑account via instant, paperless access increases the temptation to fund consumption rather than genuine emergencies.

- Repeated early withdrawals were already a concern: the Ministry’s data shows that three‑fourths of PF members once retired with less than ₹50,000, largely because they kept dipping into PF instead of allowing it to compound at over 8% tax‑free.

My Take: How Savers Should Use The New EPF Rules

I agree that the EPF is your hard-earned money, and you have a right to withdraw it hassle-free and without restrictions. However, the easy access to funds through the auto-settlement route can sometimes lead to casual withdrawals, which is not advisable.

- Treat EPF as retirement‑first money : EPF still offers a government‑backed, tax‑free interest rate (8%+ in recent years), making it one of the better fixed‑income instruments available to salaried Indians.

- Use the 75% facility only for true emergencies :

- The new ability to tap 75% of the corpus including employer share is powerful but should be reserved for high‑priority needs—major medical emergencies, genuine job‑loss stress, or situations where not withdrawing would force you into high‑cost debt.

- For planned goals like children’s education or marriage, building separate goal‑based portfolios in mutual funds or other instruments is healthier than serially withdrawing from EPF ten or five times over your working life.

- Respect the 25% minimum as “never touch” money : Think of this 25% as the absolute last line of defense—to be touched only in catastrophic scenarios where all other buffers and insurance options have been exhausted.

- Be very careful with EPS withdrawal : Staying in EPS for at least 10 years and deferring any withdrawal until pension age typically improves long‑term security, a guaranteed, inflation‑indexed pension stream for life, plus family pension if something happens to you.

Remember, EPF is your retirement savings fund and offers a decent, tax-free interest rate compared to many other fixed-income products. It should be your last resort for withdrawals. Try to stay invested for as long as possible. Treat your EPF as a long-term investment, not a quick-access fund.

(Please note that these new EPF withdrawal rules are yet to be implemented across all the EPF Regional offices. These may go live by early next year (2026) or early next Financial Year 2026-27.)

(Post first published on : 22-Dec-2025)